New Fake Trading Volume Research Casts Positive Light on Bitfinex and Binance

We’ve discussed in the recent past how certain crypto exchanges have been in engaged in wash trading and other fraudulent tactics to manipulate trading volumes on their platform.

In an unregulated market like crypto, this news isn’t shocking, yet a new research report published shows just how deep the problem runs, and which exchanges have managed to stay on the honest side of the tracks despite the obvious temptation to produce fake transactions and volume.

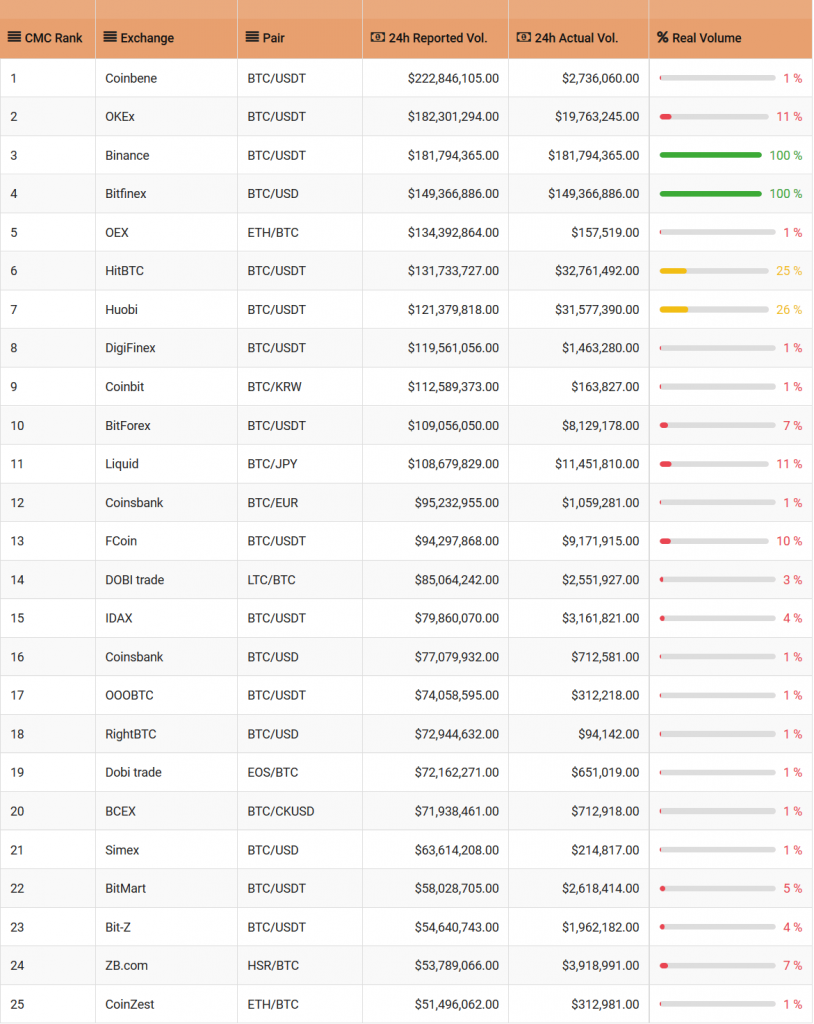

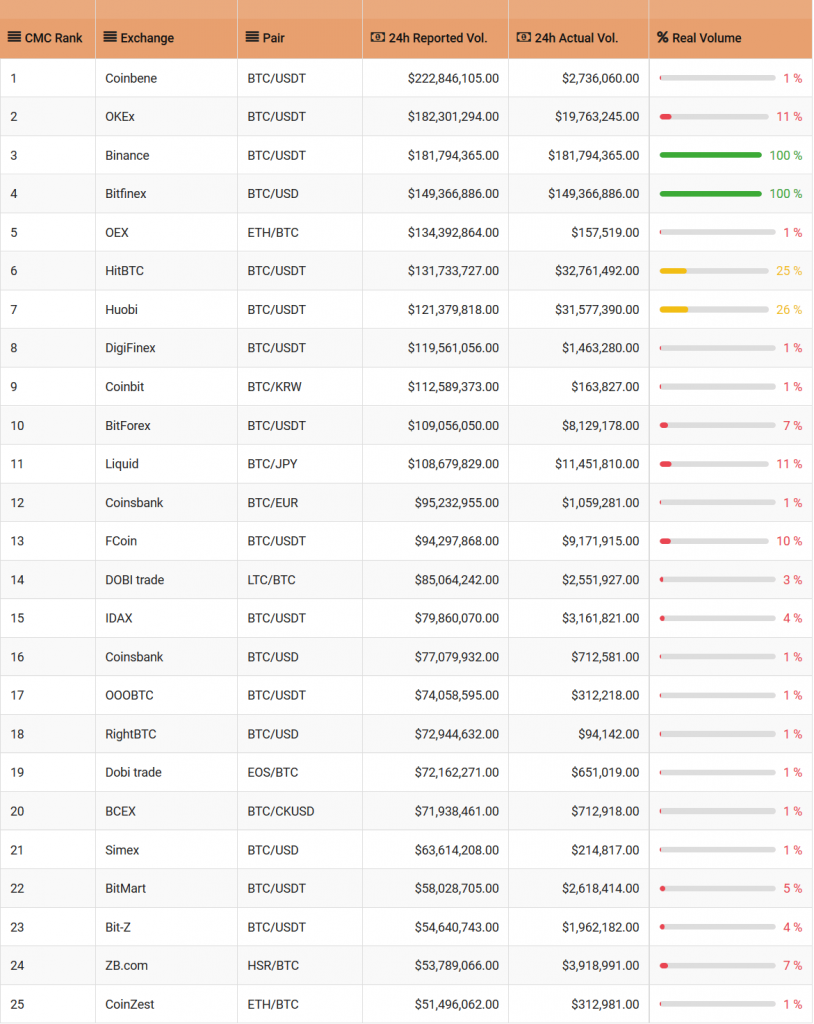

The chart below shows a list of 25 exchanges, as well as their BTC trading pairs, reported daily volume, actual volume, and the percentage of total trading volume that is considered real:

Out of all 25 exchanges, only two have been reported to be producing 100% real trading volume. Prominent exchanges like OKEX and HitBTC show 25% or less of their volume consists of actual trades.

“Based on this data over 80% of the CMC top 25 BTC pairs volume is wash traded. These exchanges continue to use these strategies as a business model to steal money from aspiring token projects”.

In addition, to wash trading, many of these exchanges also use listing fees as a significant method of income. According to the report, the average project had spent over $50,000 this year in listing fees of exchanges. It turned out that many crypto projects were overcharged to list their tokens in what are essentially wash trading platforms with far less activity than was claimed.

Bitfinex and Binance stand out as the good guys

Bitfinex and Binance seemed to stand out as the only exchanges not involved in wash trading. Bitfinex is ranked #9 on Coinmarketcap’s list of top exchanges by 24-hour trading volume, while Binance is ranked #2 behind OKEX.

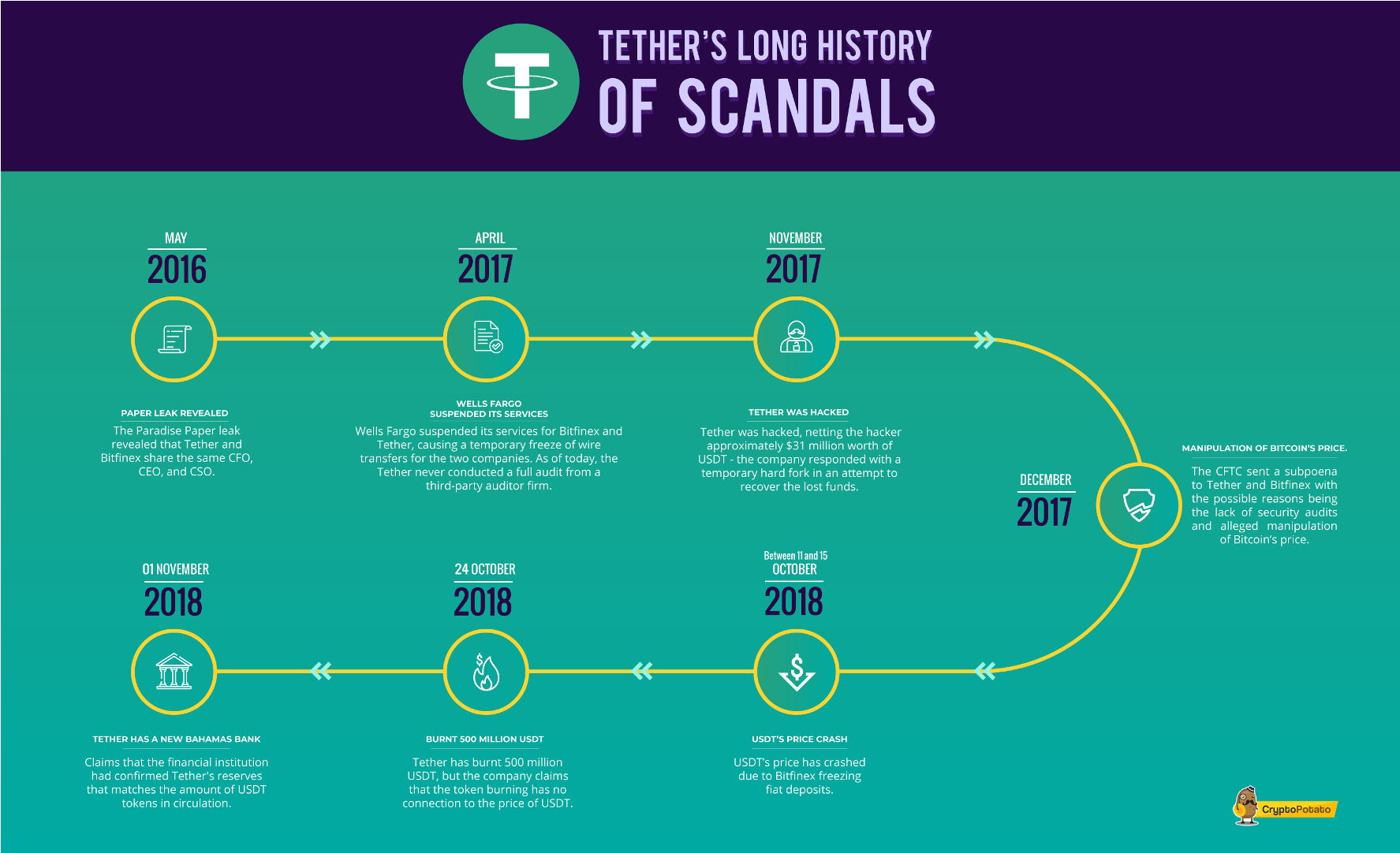

Bitfinex has been involved in its share on the controversy with Tether, which the stable coin prominently featured on the exchange. Earlier this year there were allegations that Tether and Bitfinex were both responsible for the increase in the price of Bitcoin in December last year when the value of the digital currency surged to almost $20,000.

Then more recently, fiat deposits were suspended on their platform due to a problematic relationship with their former bank, while Tethers price crashed to $0.95 due to investors losing faith in the token.

Many of these controversies seem to have disappeared as Bitfinex recently took steps to introduce a Tether/Fiat trading pair, as well as alternative stable coins and Tether had opened a new Bahamas based bank account.

The availability of Tether on Bitfinex may have been enough to grant them the authentic volume they needed to avoid engaging in wash trading.

Meanwhile, Binance and its CEO Changpeng Zhao have always held a higher standard of integrity in how they conduct their business.

Binance early dominance of the crypto markets, as well as their recent move to operate from Malta, setup BNB to become a real utility token, and establish a decentralized exchange, can act as substantial evidence for why Binance would never need to resort to wash trading.

The post New Fake Trading Volume Research Casts Positive Light on Bitfinex and Binance appeared first on CryptoPotato.